The year 2024 is recorded to be the hottest year in history. By 2030, major economies will have to cut carbon emissions by half to slow the accelerating effects of global warming. This challenge is especially critical in climate-vulnerable communities, which are disproportionately impacted by environmental degradation and populated by Black and Brown people. However, threats to programs that seek to address those in dire need of help put our national and the global environment at significant risk.

Environmental Inequities: A barrier to Justice and Mobility

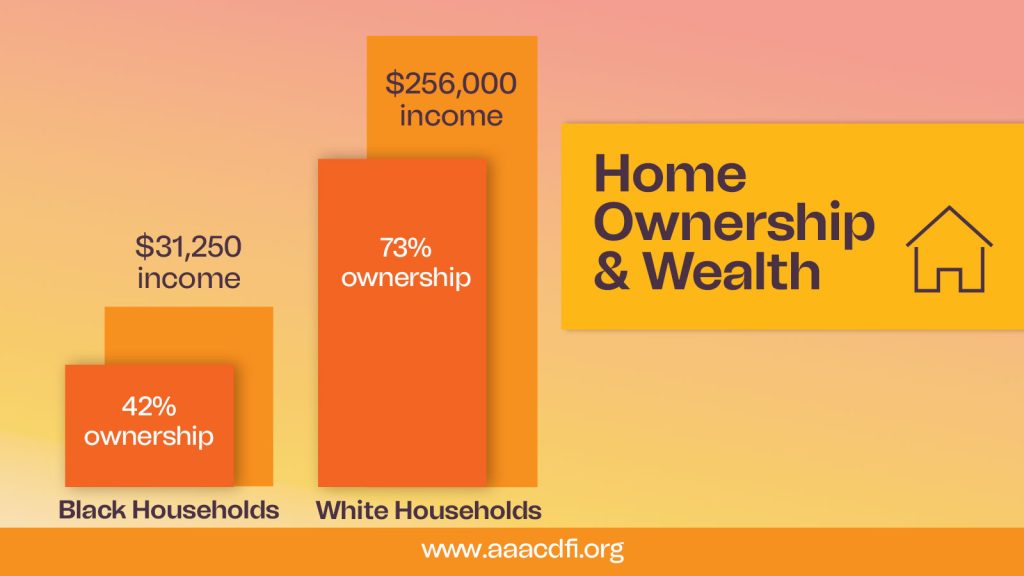

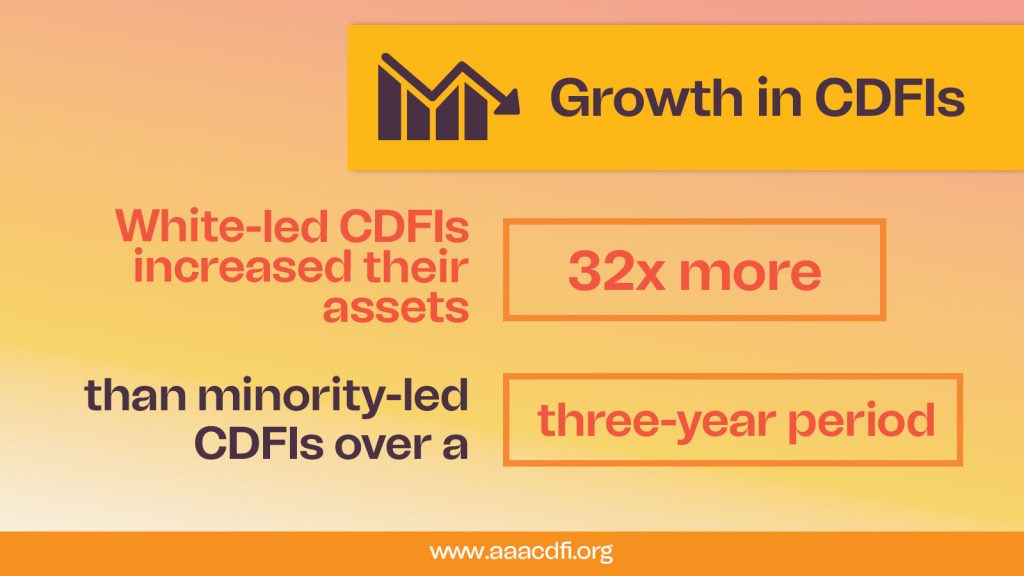

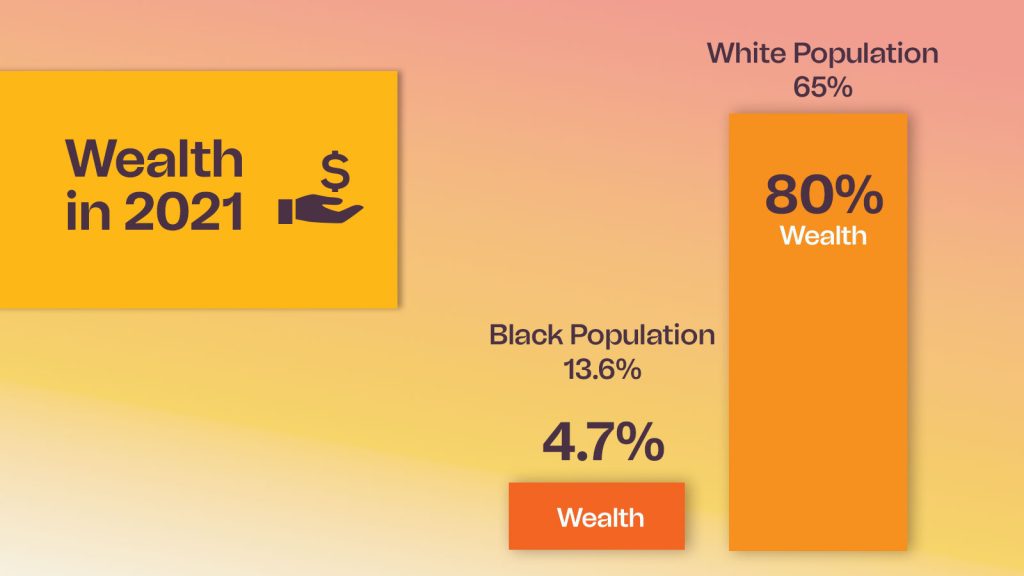

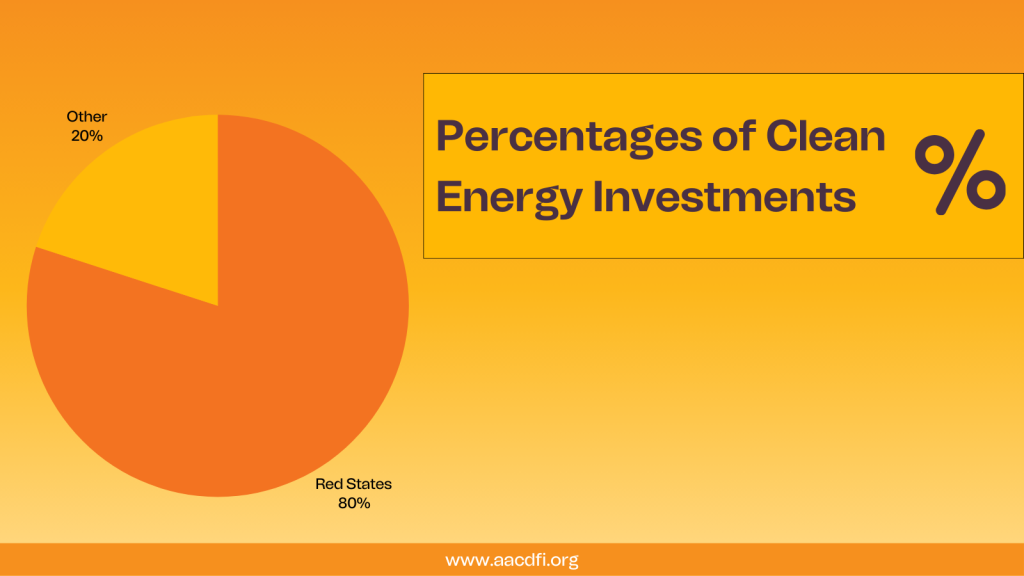

Black and Brown populations are reported to bear the brunt of climate change due to their proximity to polluting industries, lack of green spaces, and heightened vulnerability to extreme weather, flooding, and poor air quality. These environmental inequities exacerbate existing disparities in health, economic opportunity, and social mobility. Despite these challenges, these are also the communities that are historically excluded from green energy initiatives, even though they need it the most – 80% of clean energy investments are concentrated in red states, perpetuating the damaging cycle of political polarization and its echo. By Prioritizing environmental justice, we can ensure all people, regardless of race, income, or geography, have equal access to a clean and a healthy environment in which to live.

CDFIs: Catalysts for Change in the Green Economy

For the African American Alliance of CDFI CEOs (Alliance), green investments are not just an environmental imperative; they represent an opportunity to build healthier, more resilient, and economically vibrant futures for all, including underserved populations. Since its inception, the Alliance has actively pursued social and economic funding opportunities, like the Greenhouse Gas Reduction Fund (GGRF), that position CDFIs and the communities they serve to benefit from the evolving green economy. In 2023, the Alliance launched its Environment and Climate initiative (E&C), with the goal of equipping members with the education, technical assistance, and resources necessary to expand their expertise in providing green products and services. An important part of our E&C efforts is to provide access to capital for lending in the green space. The Alliance is committed to closing the gap between existing environmental disparities and the realization of environmental justice.

A Path Forward: The Role of Donors in Advancing Justice

The Inflation Reduction Act presented an opportunity for BIPOC-led financial institutions to acquire the green investment and technical assistance capital necessary to help underserved communities become active participants in the green economy. To seize these opportunities, the Alliance co-led the Community Builders of Color Coalition (CBCC), a national network of 18 organizations who advocated to ensure BIPOC communities would actively receive and benefit from the capital with a stated purpose to assist them. Through CBCC’s nonprofit arm, the Justice Climate Fund (JCF), the organization successfully secured $940 million in GGRF funding.

This funding will help CDFIs and MDIs prepare and offer green capital and technical assistance in their primarily low-to-moderate income and underserved BIPOC markets, while supporting community efforts that can lead to the creation of green jobs in undercapitalized communities. This initiative and others like it exemplify how the Alliance empowers Black-led CDFIs to build their capacity, secure resources, and drive meaningful change that benefits everyone. However, there are some limitations to the program and sustained progress requires robust donor support.

How Donors Can Support the Movement

With your help, the Alliance can continue its E&C and other programs that strengthen the capacity of our members. Your contributions can also assist us in helping our members access the capital they need to deploy in underserved communities throughout the nation. As a donor, your support will help us do the following specific things:

- Support Black-led CDFIs who provide competitive capital, training, affordable housing, and community facilities to marginalized entrepreneurs and consumers.

- Provide programs that address the racial disparities Black-led CDFIs face when working to support low-to-moderate income and other underserved communities.

- Invest in research that quantifies the impact of CDFIs on dismantling racial wealth disparities.

- Facilitate the continuing partnerships between CDFIs, MDIs, other community development organizations, and advocacy groups to advance collaborations and policies that can remove systemic barriers to economic opportunity for the underserved.

- Equip CDFIs with the strategies needed to collaborate and advocate for impactful policy change at local, state, and federal levels.

- Drive public awareness of the role CDFIs, especially Black-led CDFIs, play in advancing racial economic equity.

CDFIs stand at the intersection of justice, innovation, and impact. Investing in their capacity is not only a step toward achieving environmental equity but also a commitment to creating a more inclusive and just economy.

With your support, the Alliance can continue to advance its mission of empowering Black-led CDFIs to drive environmental justice and economic mobility in underserved communities. Together, we can create lasting, and meaningful change, ensuring a brighter, more equitable future for all the generations to come. Donate to The Alliance today and Help Us Help ALL of Us!