Roadmap Aims to Address Housing Justice for BIPOC Communities

ORLANDO, FL – In recognition of National Homeownership Month, the African American Alliance of CDFI CEOs (The Alliance) unveils its pioneering Housing Initiative Roadmap, aimed at empowering BIPOC (Black, Indigenous, and People of Color) communities in their pursuit of housing justice. Developed with support from the Melville Charitable Trust (The Trust) and in collaboration with Cappelli Consulting, this comprehensive roadmap marks a significant milestone in our commitment to eradicate policies that perpetuate racial housing instability.

The Housing Initiative Roadmap embodies The Alliance’s unwavering dedication to dismantling systemic barriers and fostering equitable, and inclusive housing opportunities. By providing Alliance members with comprehensive access to essential resources, tools, and strategies, we are catalyzing transformative change and advancing social equity in the housing sector.

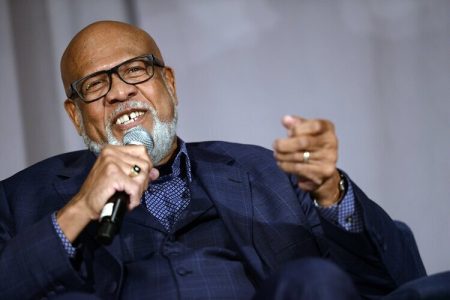

“Housing justice is fundamental to achieving true equity and inclusion,” said Lenwood V. Long, Sr., CEO of The Alliance. “Our Housing Initiative Roadmap is a testament to our collective determination to address the disparities facing BIPOC communities and ensure that every individual has access to safe, affordable, and dignified housing.”

“The state of housing for Black America has been challenging. To help communities of color build generational wealth and repair the harms of structural racism, we must focus on housing stability. As community development financial institutions (CDFIs) we can play an important role in leveling the playing field,” said Donna Gambrell, Alliance Board Chair and President & CEO of Appalachian Community Capital.

The Alliance Housing Initiative aims to overcome housing justice obstacles and change the narrative on housing in BIPOC communities. The goals of the Housing Initiative Roadmap include empowering members to advocate for anti-racist housing policy reform at the federal, state, and local levels, encouraging members to adopt best practices that increase housing opportunity and improve housing stability in Black and brown communities, and strengthening the capacity of members to develop, deliver, and evaluate effective anti-racist housing programs.

“We cannot end homelessness without major investments in housing. This roadmap outlines key strategies to strengthen Black-led CDFIs and to accelerate the critical investments in advocacy and capacity needed to build a more equitable housing system,” said Alyia Gaskins, Senior Program Officer at the Melville Charitable Trust.

“We cannot close the racial wealth gap and address the inequities without major interventions in the housing development system. To this end, we must strongly advocate for a housing system that centers the needs of BIPOC communities,” said Marshall Crawford, Alliance Board Member and President and CEO of The Housing Fund. “This roadmap is just the beginning of The Alliance and our partners efforts to create a more just housing system.”

“Black-led CDFI’s are some of the most essential institutions driving resources and solutions to struggling communities most affected by disinvestment and economic exploitation across the country in both urban and rural America. Our organizations, however, are affected by many of the same policies that drive lack of resources and the wealth gap in the communities we serve. This Roadmap establishes a strategic plan for the Alliance to advocate for and secure the policies and resources members need to help build thriving communities of color nationwide,” said Anthony Simpkins, Alliance member and President and Chief Executive Officer of Neighborhood Housing Services of Chicago, Inc.

As we embark on this journey, The Alliance invites stakeholders, policymakers, and community members to join us in our collective pursuit of housing justice for all. Over the coming months, The Alliance will collaborate with leaders and advocates in the housing industry to deliver impactful housing programs to our members. Together, we can create a future where every individual, regardless of race or background, has access to safe, affordable, and stable housing.

To learn more about the Alliance Housing Initiative Roadmap and get involved in our efforts, visit please visit http://www.aaacdfi.org.

# # #

African American Alliance of CDFI CEOs

The African American Alliance of CDFI CEOs, known as “The Alliance,” is a membership organization consisting of 79 CEOs from Black-led Community Development Financial Institutions (CDFIs). These institutions include loan funds, credit unions, venture capital firms, and non-profit developers. Since its establishment in 2018, The Alliance’s extensive network has provided services across all 50 states and the District of Columbia. To learn more about The Alliance and its programs, please visit http://www.aaacdfi.org.

Media Contact:

Alisha Brown / African American Alliance of CDFI CEOs

[email protected] / 901-849-0820