FOR IMMEDIATE RELEASE

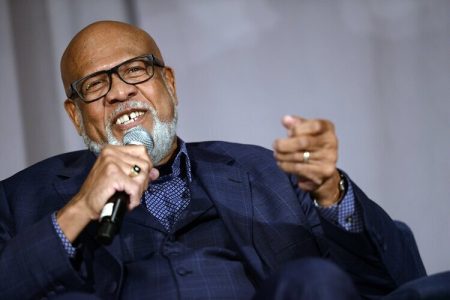

The Alliance ushers in next chapter of leadership and growth as Founder & CEO Lenwood V. Long, Sr. retires

Orlando, Florida — January 6, 2026 — The African American Alliance of CDFI CEOs (“The Alliance”) proudly announces that Amber Banks has been appointed President & CEO, effective January 1, 2026. Banks succeeds Founder & CEO Lenwood V. Long, Sr., who is retiring after more than three decades of service in community finance and economic justice.

With more than two decades of experience at the intersection of economic development, social justice, and nonprofit leadership, Banks brings a bold vision for expanding access to capital, strengthening Black-led CDFIs, and elevating the Alliance’s voice on the national stage.

“Amber’s appointment marks an exciting new chapter for the Alliance,” said Watchen Harris Bruce, President & CEO of Baltimore Community Lending and Chair of the Alliance Board of Directors. “Her deep expertise in racial and economic equity, her proven ability to build inclusive leadership, and her passion for community-driven solutions make her uniquely qualified to guide the Alliance into the future.”

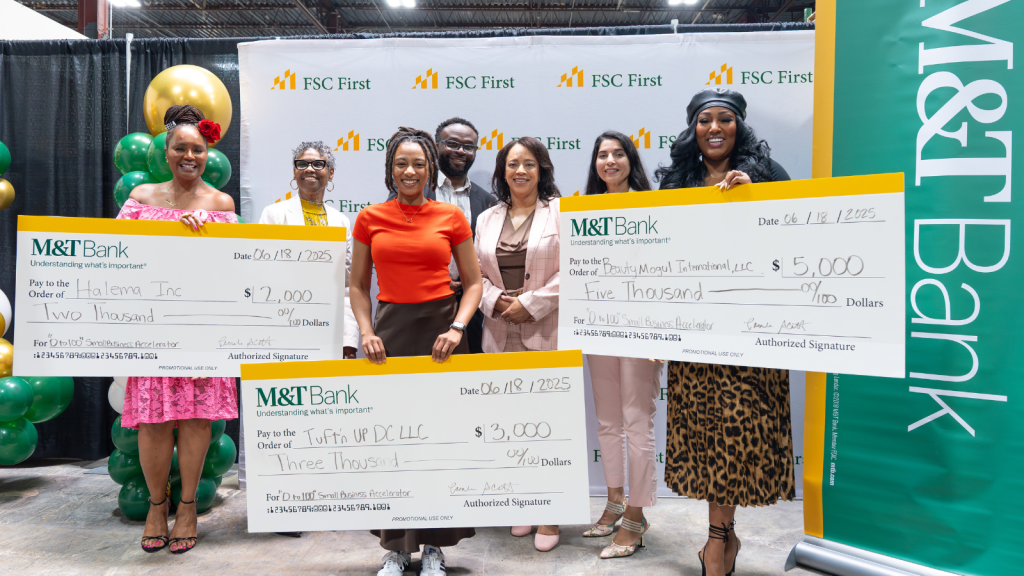

Banks has led initiatives that unlocked millions of dollars in lending for entrepreneurs of color, built national coalitions to channel philanthropic and federal resources into underserved communities, and mentored a new generation of diverse leaders in community finance. She has also been a cornerstone of the Alliance’s leadership team since its early years, serving first as Executive Vice President & Chief Operating Officer, where she strengthened operations, improved systems and processes, and aligned staffing and resources with strategic priorities. She was then promoted to President in 2024, where she spearheaded strategies to advance the organization’s mission, oversaw financial planning and resource allocation, cultivated national partnerships, and represented the Alliance as one of its lead spokespeople with media, policymakers, and stakeholders.

“I am honored to carry forward the Alliance’s legacy, to strengthen our membership, and to confront the racial wealth gap as a united force,” said Amber Banks, President & CEO of the Alliance. “This is not just my leadership moment, it is our movement – and I can’t wait to roll up my sleeves, work with our members, and take our fight for equity to the next level.”

Under her leadership, the Alliance will focus on:

- Expanding lending and capitalization for Black-led CDFIs.

- Elevating the voice of Black economic leaders in national policy and industry conversations.

- Strengthening member services with measurable benefits and expanded support.

Founded in 2020 under the leadership of Lenwood V. Long, Sr., the Alliance has grown into a national membership organization representing more than 80 Black-led CDFIs and 40 mission-driven organizations. The Alliance has secured historic federal and philanthropic funding, launched groundbreaking initiatives such as the Equity Impact Scorecard, Black Renaissance Fund, and established itself as a leading voice for racial and economic justice.

To learn more about The Alliance, visit www.aaacdfi.org.

# # #

About the African American Alliance of CDFI CEOs

The African American Alliance of CDFI CEOs is a coalition of 129 Black-led community development financial institutions (CDFIs) and mission-driven organizations committed to closing the racial wealth gap and expanding economic opportunity in Black and historically excluded communities. Through advocacy, capacity-building, and partnership, the Alliance equips its members to grow their institutions and strengthen their impact.

For more information, visit www.aaacdfi.org.

Media Contact

Iyanna Peoples

Associate, Marketing & Communications

African American Alliance of CDFI CEOs

[email protected], (910) 518-9201