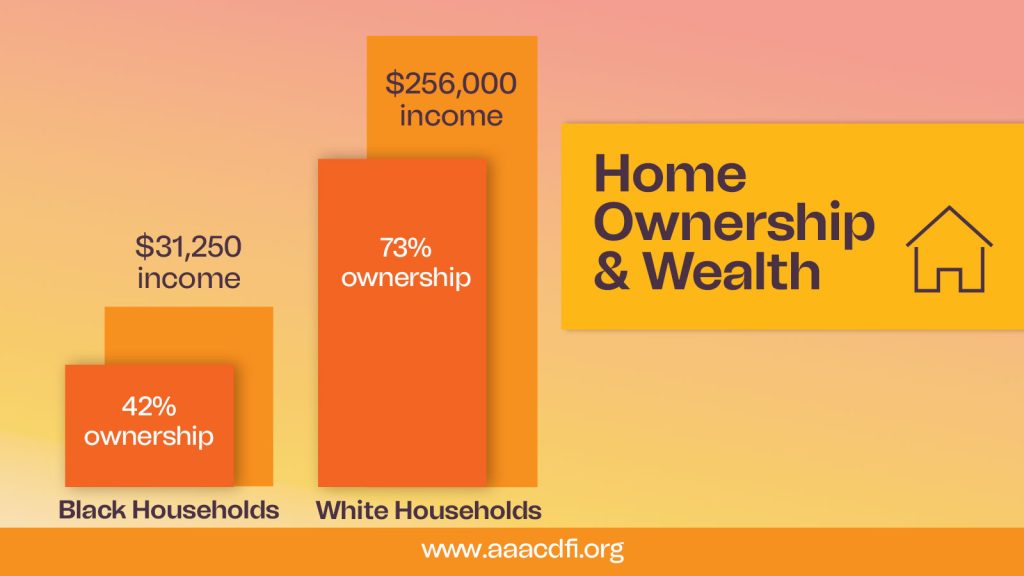

If I were to offer you an opportunity, which would you prefer: one that will provide you with $256,000 or $31,250 for the same effort? If I gave you the freedom to pursue the $256,000 opportunity, would you try to prevent me from giving that same level of opportunity to everyone else? Seriously, think about your answer to this question because this is the situation we have faced in this nation for more than a century; Certain people who want to take advantage of opportunities are inhibited by others that have already been given the opportunity. Why is this the case when there are more than enough opportunities for those that want them? The issue is and has always been prevention. We invite you to imagine.

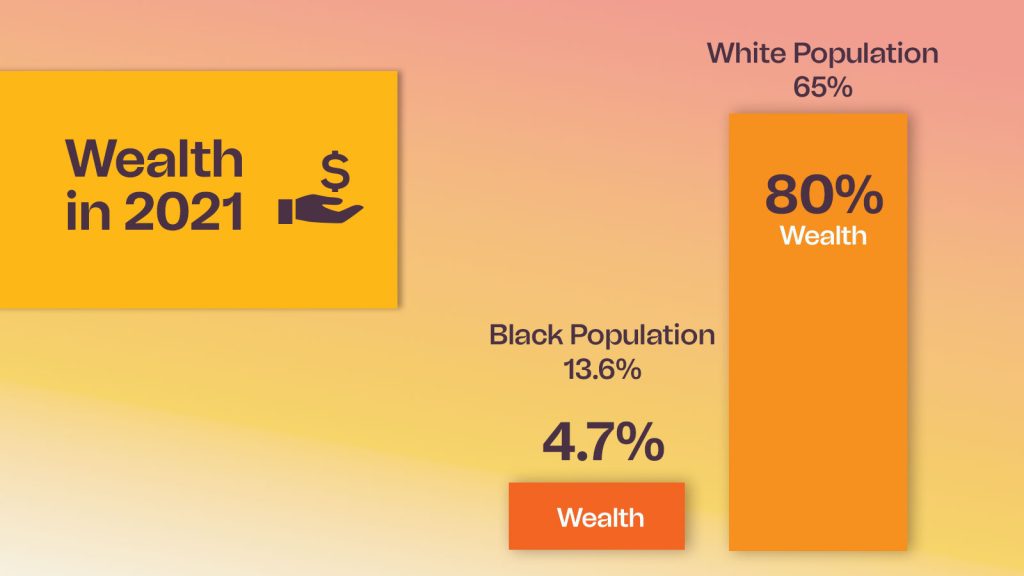

First, U.S. wealth by race is not in balance. Let’s take a look at some of the data from trusted sources. According to the U.S. Census Bureau’s 2022 data, the average net worth of a White household is $256,000 while that of a Black household is just $31,250, the lowest of any racial or mixed-race group. In 2021, 80% of the wealth in this country was owned by White people who make up just 65% of the population and Black people held just 4.7% of the wealth although they were 13.6% of the population.[1] More than 73% of White Americans own their home while just 42% of Black Americans do. The recent jump in home values thus provided an even greater increase in equity or access to capital for White Americans while Black Americans were further cash strapped by higher rents.

Now, let’s look at the reports from the U.S. Department of the Treasury and others on race and the economy.

“The racial gaps in economic security in the United States are stark and have been exacerbated by policies that hinder people of color from building wealth. Moreover, inequitable policies and practices that prevent wealth-building by some groups have been shown to negatively impact economic security for all.”[1]

The, “…large disparities in wealth by race [is] a serious concern for the economic health of families and the U.S. economy as a whole.” Furthermore, The Treasury under Secretary Yellen wrote in their 2024 report, “Treasury has designed and implemented an ambitious racial equity agenda to address longstanding disparities in investment and opportunities that keep some communities from fully benefiting from and contributing to the nation’s economic growth and prosperity. This agenda is integral to the Treasury’s overall mission, which is to maintain a strong economy by promoting conditions that enable equitable and sustainable economic growth at home and abroad, combat threats to and protect the integrity of the financial system and manage the US government’s finances and resources effectively.” [2]

Racial economic equity is therefore critical to our success and even survival as a nation. Therefore, energy and capital should not be wasted working to prevent the most economically depressed population from accessing capital that will allow them to contribute to the building of this, our shared economy.

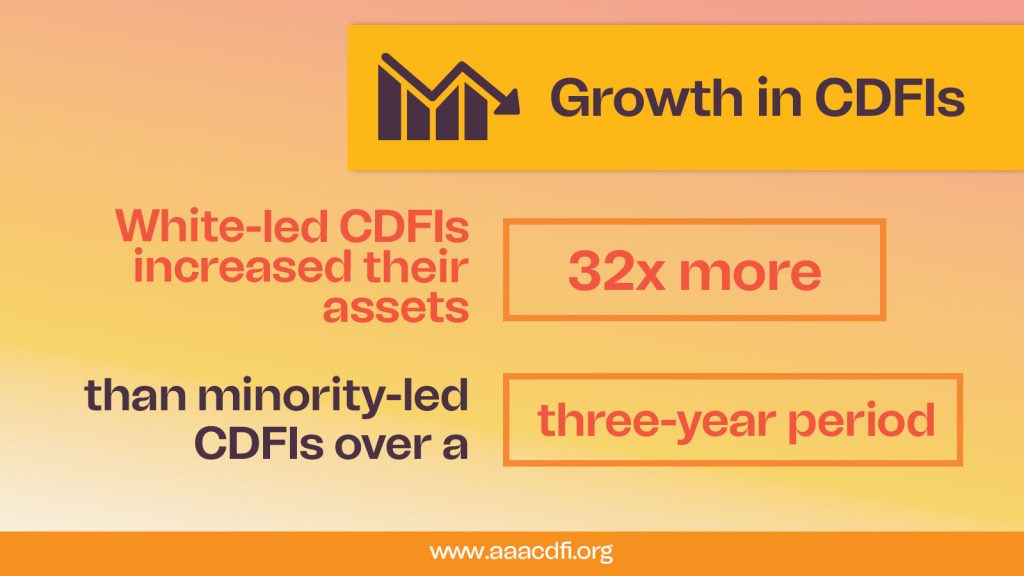

One way the Treasury works to provide access to capital is by supporting CDFIs (Community Development Financial Institutions) which are entities they certify and oversee, ensuring they provide capital and technical assistance to underserved small businesses, developers, and consumers. These underserved borrowers are largely low-to-moderate income (LMI) and BIPOC (Black, Indigenous and People of Color). However, there is racial disparity even among CDFIs. A Hope Policy Institute study showed that White-led CDFIs grew their assets nearly 32 times greater than the growth of BIPOC-led CDFIs during a three-year period.[3] That is where the African American Alliance of CDFI CEOS stepped in.

The Alliance is a national, membership-driven, intermediary organization that as its mission aims to: build the capacity of member organizations; build bridges to economic stability, well-being, and wealth for Black individuals, families, and communities; and build power in Black communities by challenging and influencing financial sectors to operate more equitably. We are committed to closing the racial wealth gap through our work with Black-led CDFIs.

Why Black-led CDFIs? Because they are at the forefront of supporting underserved LMI, BIPOC and particularly Black communities that are trying to overcome racial inequities in lending and other types of finance. In her 2021 comments regarding the government’s support for CDFIs, Secretary Yellen mentioned that in 2020, 71 percent of all venture funding was concentrated in just four metropolitan areas.[1]

“This is a very unjust aspect of our economy…But I would also add: It’s a very unhealthy aspect of our economy. If you were designing a well-functioning American economy, you wouldn’t have 70 percent of capital (in any form) flowing to just four cities. Because that’s not where 70 percent of the opportunity is. We – as a country- are missing out on so many avenues for growth because our capital is bottlenecked by race and region.”

In 2021, the Fed’s small business survey indicated that over the prior year, 40% of all White-owned businesses received all the non-emergency funding they applied for while just 13% of Black-owned firms did even when credit and other factors were similar. Greater access to capital is needed to help Black-owned businesses implement and build generational wealth through their business plans as their White counterparts have had the privilege to do for more than a century.

Through our programs, initiatives and policy and research work, the Alliance helps African American CDFI leaders get the support and capital they need to in turn help underserved entrepreneurs build wealth and contribute to a thriving economy. Members serve all 50 states and U.S. territories, and they provide capital, training, and technical assistance to underserved entrepreneurs engaged in small business, affordable housing, community development, health, and education, helping them to grow sustainably toward closing the racial wealth gap.

What the Alliance does matters, and it works! Over the last three years, our surveys show that more than 80% of those served by our members are LMI and BIPOC, and our members have significantly increased their lending and technical assistance capacity by more than 25%. But much more needs to be done to meet the needs of underserved BIPOC entrepreneurs.

“The racial gaps in economic security in the United States are stark and have been exacerbated by policies that hinder people of color from building wealth. Moreover, inequitable policies and practices that prevent wealth-building by some groups have been shown to negatively impact economic security for all…Policies that address racial wealth disparities, therefore, have the potential to benefit all Americans not only by spurring economic growth but also through public investments that benefit everyone.”[1]

The Alliance is doing its part, and we ask you to join us! By supporting the Alliance, you will help our more than 100 members expand their offerings and increase their capacity to provide capital to entrepreneurs who have been largely excluded from traditional sources of finance. You will also support the Alliance in continuing its national efforts to make access to capital more equitable for everyone. Donate to the Alliance today and Help Us Help ALL of Us!

For more information, please visit our website aaacdfi.org